THE FAST, EASY WAY TO GET PAID

With PayID®, people can pay you using just your mobile number.

What is PayID?

A fast, easy and secure way to pay and get paid

- Your mobile number is as unique as your BSB and account number, and now you can use it to receive money.

- Register your mobile number as a PayID for an eligible bank account, and that's all people need to know to transfer you funds.

What’s great about PayID?

Fast payments

PayID payments between participating banks are made in real time, so you pay and get paid fast.1

Easy to remember

All the payer needs to know is your mobile number rather than your BSB and account number.

Know you’re paying the right person

The payer sees your name on their screen, reassuring them that they’re paying the right person.

Costs you nothing

PayID is free to set up and there are no fees to use it.

Safe and secure

Transactions made using PayID have the same level of security that protects your existing bank account payments.2

Simple to set up

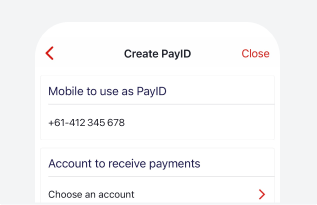

Register your mobile number as your PayID in Online Banking or the Westpac App.

Quick set up guide

- Make sure you have the latest version of the Westpac App

- Search for PayID, tap on it, then follow the prompts.

- Select Service > Services > PayID

- Select Register now and follow the prompts.

How do I receive money by PayID?

Someone’s paying you:

- Once you’ve set up your PayID, ask to be paid by PayID using your mobile number

- The payer selects to pay you using PayID in their online or app banking and enters your number and the amount

- They can see it’s you they’re paying before confirming

- You’ll receive a payment notification if you have these notifications enabled.

How do I pay by PayID?

You’re paying someone:

- Sign into Online Banking or the Westpac App and go to the payment section

- Add a new PayID/mobile number or choose an existing PayID payee, and enter the amount

- If the payee is registered for PayID, their name will be displayed on your screen to reassure you that the correct person is being paid

- Once you confirm, the payment should be delivered in under a minute.

PayID is super handy when…

You’re splitting a restaurant bill

You’re collecting money for a shared present

You’re contributing to a shared expense

You’re selling something online

You’re giving money as a gift

You’re sending money to a loved one

FAQs about PayID

No, people can still pay into your account using your BSB and account number. But with PayID, they have the reassurance of seeing that it’s you they’re paying (because your account name appears on screen) before they confirm the payment.

Your PayID is a unique identifier that can only be registered at one bank and linked to one eligible account.

For personal accounts however, if you have more than one mobile number, each could be used as a unique PayID. For example, you may be able to use one number for a PayID that links to a Westpac account and a different number for a PayID that links to an account at another participating bank.

Contact the bank where you set up your PayID and ask to put it into a ‘transfer state’. You then have up to 14 days to set up your Westpac PayID before it reverts to the current bank.

Here’s how to set up a Westpac PayID:

In the Westpac App

- Search PayID in the Smart Search bar

- Tap PayID settings then Register now and follow the prompts.

In Online Banking

Personal customers

- Go to Service > Services > Account Services > PayID

Business customers

- Go to Service > Services > Account Services > PayID settings > Create new PayID

You can do this anytime in Online Banking or the Westpac App and you don’t need to tell anyone you’ve changed the account your PayID pays into.

In the Westpac App

Make sure you update to the latest version of the app.

- Search PayID in the Smart Search bar

- Tap PayID settings

- Select Change account to pay and follow the prompts.

In Online Banking

Personal customers

- Go to Service > Services > Account services > PayID

Business customers

- Go to Service > Account Services > PayID settings > Change account to pay.

PayID costs nothing to set up and there are no fees for making and receiving payments via PayID. However, other account fees and charges may apply.

You may notice the round Osko logo on your payment screen. The Osko by BPAY® service enables near-instant payments to a PayID or an eligible BSB and account number(s). You’ll see the name or logo when you make or receive a payment that’s been through the Osko system.

Yes, and you can use your ABN as your PayID while using your mobile number as your personal PayID. Follow the same set up steps to link a PayID to a Westpac business account.

Things you should know

1. Fast or real-time payments are sent and received using Osko by BPAY® and can be addressed to either a PayID or a BSB and account number. You can also receive fast payments via Single Credit Transfers. Real-time payments require both the payer and payee to have Osko enabled accounts. Payments may take longer in some instances, such as where there is a technical interruption to the service, there is a payment to a first time payee or when the payment is caught for additional security screening.

Personal customers can send and receive fast Osko payments to and from participating financial institutions with an eligible account (i.e. a personal transaction account).

The PayID types available to you may vary depending on your customer profile. If you register your mobile as a PayID, it needs to be the same as your Westpac Protect™ SMS Code.

When your PayID is registered, your details (including your name) will be available to people who use the service and enter your mobile phone PayID.

Westpac Mobile Banking applications are only available for use by Westpac Australia customers. Internet connection is needed to access Westpac Online Banking and the Westpac App. Normal mobile data charges apply.

2. Online Banking Security Guarantee. If your Westpac account is compromised as a result of internet fraud, we will repay any missing funds providing you comply with our Online Banking Terms and Conditions (PDF 1MB).

PayID® and PayTo are registered trademarks of NPP Australia Limited.

BPAY® and Osko® are registered trademarks of BPAY Pty Ltd ABN 69 079 137 518.